|

Since the start of 2020, nowhere in the world has escaped the virus or the severe disruption caused by measures to contain it. From California to Hong Kong, lockdowns and working from home have become a way of life. Economies have been stopped in their tracks, while the travel, hospitality and retail sectors have been decimated. Conditions for cross-border property hunting have not been ideal. But that’s not to say all property markets have been affected adversely, or if they have many are now rebounding. Stimulus packages parachuted in by governments and central banks have helped a lot, complemented in many countries by historically low interest rates, with no signs of this changing. In the UK, the stamp duty holiday has given the market a noticeable boost. With all this in mind, here are three contrasting overseas destinations that might appeal to luxury property-hunters in 2021. Portugal Portugal’s famous Algarve coastline needs little introduction as one of the world’s top tourist destinations. In recent years though, it has become a go-to European option for foreigners in search of a home with low taxation and a laid-back, quality lifestyle. This is thanks to the combination of its Golden Visa scheme with its Non-Habitual Resident scheme (NHR), which offers a decade of generous tax breaks for new foreign residents. The Algarve resorts of Vilamoura, Vale do Lobo and Quinta do Lago are established hot spots for house-hunters at the luxury end of the market. However, for less touristy but equally scenic destinations, the Comporta region, 120 kilometres south of Lisbon, is increasingly on the radar. Regarded by the Portuguese as one of the most exclusive areas to own a summer home, the region includes the Alentejo coast, which currently is seeing the launch of new hotels and exclusive residential developments. “Portugal is one of the most sought-after countries in Europe to invest due to its advantageous taxation laws, the Golden Visa programme, its pleasant climate and the high standard of living. The combination of these reasons, together with a low rate of coronavirus cases this year and region’s proximity to Lisbon, is why we are registering strong demand in Comporta.” Switzerland A bastion of financial security set amongst glorious mountain scenery, Switzerland’s strong currency and aversion to debt are immediate attractions of owning Swiss Franc assets. Much like the US dollar, its currency is a safe haven for international investors, especially when there is uncertainty in world markets, such as that created by COVID-19 and Brexit. Swiss interest rates are being held in negative territory (-0.75 per cent), making premium Swiss property especially attractive. Bear in mind second homeownership by foreigners is restricted in Switzerland. For wealthy investors who become resident there its tax system, which levies taxes at federal, cantonal and municipal level, has attractive incentives. A popular option for foreigners, applicable in for example in Valais and the resort of resort of Verbier, is the Lump Sum Taxation scheme, which allows residents to be taxed on their annual living expenditure rather than worldwide income or assets. Equally, there are attractive schemes for foreigners wishing to set up a company in order to register and work as self-employed. In Geneva, the lockdown effect means more homebuyers are opting to be away from the traditionally popular city-centre or opulent lakeside suburbs. Instead, today’s typical overseas relocators are choosing smaller communities such as Anières and Hermance, 10 kilometres north of Geneva on the left of bank of Lake Geneva. Knight Frank’s Geneva office saw a 60 per cent rise in enquiries in June 2020 this year compared to 2019. Dubai

The UAE’s most populous emirate is buzzing again. Recent figures from a leading Dubai property agency highlight just how bullish the market there is right now: sales transactions (volume) in November 2020 were up 42 per cent on the same month last year and lettings transactions rose 81 per cent year-on-year in December. Pent-up demand, effective management of COVID-19 (the UAE is on the UK’s travel corridor list) and the anticipated economic benefit of hosting the world famous Expo 2020 (now 2021) are helping to drive things. Another factor underpinning steady interest is the introduction this summer of the Dubai Retirement Visa. It forms part of the government’s new Retire in Dubai drive to encourage more wealthy expats to relocate or continue to live in the city. “To be eligible for a retirement visa, an option is to own a property in the country that is not mortgaged and is worth no less than AED 2,000,000. Another option is to have a monthly income of AED 20,000 and we have had many enquiries of expats broadening their property portfolio in the city to build up their monthly income with retiring in the UAE at the forefront of their ambitions.” Reflecting the effects of lockdown on buyer preferences, the agency’s most popular area for sales in the third quarter of 2020 was unusually the villa community of Arabian Ranches. Villa communities are proving to be in high demand as people value outdoor space now more than ever. Historically a temporary place to stay before moving back to their home country, signs point to Dubai maturing into a forever home for many of its resident expats. Why not speak to one of our real estate specialists about purchasing property in ? We are a boutique investment firm with years of experience delivering bespoke residence and citizenship-by-investment solutions for international families. At Prime Land Ventures, we can simplify access to property investments, provide local insights, help with legal assistance, tax planning, and more—all while ensuring efficient, personalized, and confidential service

0 Comments

Why you should consider hotel real estate syndication and how to find the right investment partner who will maximize your returns. If you are interested in the potential high returns that come from investing in hotel real estate but don’t have the time, expertise, or inclination to do due diligence, structure the deal, and manage the property—you don’t have to forego these lucrative investment opportunities. By investing through hotel real estate syndication, you can have all of the benefits of owning a commercial real estate investment without the hassle. Here’s what you need to know. What’s Real Estate Syndication? In its simplest definition, real estate syndication is a group of individuals pooling capital together for the common purpose of purchasing and managing a property with multiple owners. There are typically two parties involved in real estate syndication—the sponsor and the investor. The sponsor (also sometimes called the syndicator, asset manager, general partner, GP, or operator) is the individual or company in charge of finding, acquiring, and managing the property. They also underwrite and complete the due diligence of the asset. Meanwhile, the investors (often called the limited partners or LPs) provide funding and own a percentage of the real estate being acquired. They enjoy the benefits of property ownership without getting involved in the actual process of acquiring the property, such as arranging financing and being responsible for the day-to-day asset management. Sometimes, a joint venture (JV) or equity partner may be involved. These groups typically have access to many investors and can serve as a conduit between the sponsor and the investors. Besides potentially facilitating financing, they may also assist the sponsor with investor reporting and communication as well as tax documentation. How Can Investors Benefit From Syndicated Hotel Real Estate Deals? Hotel real estate syndication allows investors to broaden their access to deals with the potential for high returns without spending the time to research hundreds of properties. As limited partners, they can take advantage of the passive nature of the investment without the hassle of managing the properties. When you work with sponsors who have a track record of success, you can rely on them to manage the property’s day-to-day operation and ensure the highest ROI. They’ll also give you monthly or quarterly updates on your investment to keep you informed. Investing in syndicated hotel real estate allows you to diversify your portfolio into an asset class that’s not directly tied to the public markets. This can help protect your investments during a financial crisis or recession. Hotel syndications also have the benefit of being able to improve overall yields through tools such as dynamic room pricing, monetization of meeting/conference rooms, food and beverage services, etc. Lastly, a large commercial property offers investors economies of scale in their contracts for property management, renovation expenses, cleaning services, etc.—which can improve the profitability and return on investment compared to smaller, non-syndicated investments. What You Need to Know When Underwriting a Hotel Deal When you partner with a real estate syndication sponsor, they are responsible for doing the due diligence and underwriting the investment. Making and confirming accurate underwriting assumptions is one of the best ways to ensure that a deal is successful and profitable. Typically, the sponsor will provide you with financial projections of the investment and can often outline some of the main assumptions included in the underwriting. It is beneficial to understand how changing some of these assumptions can impact the returns of the investment. Here are some an experienced hotel syndication investor considers when reviewing a deal:

How to Align the Interest of the Sponsor and the Investors

To ensure success in hotel real estate syndication deals, the interests of the sponsor and the investors must align. This can be accomplished in several ways:

Finding the Right Hotel Real Estate Syndication Sponsor Working with the right sponsor is the key to hotel real estate investment success. Here are some criteria you can use to evaluate your potential partner:

Partnering with a reputable and experienced hotel real estate syndication sponsor can maximize your investment while eliminating the hassle. If you are interested in learning more about the lucrative financial returns that can come from investing in hotel real estate, with returns often ranging from 12-26%, please contact us Invest in Colombian real estate in 10 steps Intrigued? Before moving forward, there are several important considerations investors should be aware of before purchasing Colombian real estate. Step 1: Travel to Colombia. Whether you are eager to buy today or are on the fence about purchasing a property in Colombia, we urges prospective investors to visit different parts of the country and make sure reality matches up with individual expectations. In Colombia, you can rent a local apartment in the city you are planning to move to or invest in and get a feel for the local vibe. If you’re not familiar with other Colombian cities, take time to scout them out and see how each compares. Step 2: Choose a city. Visiting Colombia will prepare investors for taking their next step: choosing a city. Investment opportunities can be found across Colombia, but the big four—Bogotá, Medellín, Cali, and Cartagena—offer some of the most promising ones. Medellín, aka La Ciudad de Eterna Primavera, charms with its eternally spring-like weather and fascinating history, while Bogotá wins hearts with its thriving nightlife and blossoming food scene. Cali beckons explorers with vibrant salsa beats. Cartagena, the jewel of Colombia’s Caribbean coast, calls to beach lovers with sun and sand. Step 3: Choose a barrio. After exploring the ins and outs of your new city, investors will be ready to decide where they want to live. Many of the cities in Colombia—including its four major destinations—are divided into neighborhoods, or barrios, each of which has a distinctive flare. We’ll discuss some of our favorite barrios in each city below. Medellín: A darling among expats, Medellín is home to a number of popular neighborhoods for foreigners. El Poblado—with its nightlife, upscale restaurants, and shopping—is a top choice. However, some digital nomads and younger professionals prefer Laureles and Envigado. Bogotá: A modern city, Bogotá has everything from sleek and stylish residential zones to bustling bohemian neighborhoods. We recommend Chapinero, which is packed with dining options, cafés, nightlife, and more. Cali: An up-and-coming destination, Cali is a favorite among travelers seeking an off-the-beaten-track adventure. Our favorite neighborhoods in the salsa capital of the world are El Peñon, Granada and San Antonio—lush, tree-shaded barrios with a flourishing restaurant scene. Cartagena: Heading to sunny, beachside Cartagena? We suggest Manga, a burgeoning residential neighborhood within walking distance of the historic Old Town and Getsemani. Step 4: Hire a bilingual local team. When it comes to finding your ideal property in your preferred city and neighborhood, we emphasizes the importance of finding a reliable team that is familiar with the local market and Colombian real estate regulations. We recommend building a locally-based, bilingual team made up of the following: A real estate agent. Particularly for investors whose Spanish is not fluent, it is highly advisable to find a bilingual agent. A local agent can help buyers find a property that matches their requirements for location, amenities, price, and investment potential, and then assist in negotiating terms with the seller. A real estate attorney. Beyond an English-speaking local agent, it is important that investors seek guidance from a bilingual attorney. In Colombia, contracts must be written in Spanish to be considered legally binding. The attorney will assist in drafting the sales contract, performing a title search, ensuring that the buyers funds are properly registered with the Central Bank, and assist in crafting the terms and conditions for the closing. Step 5: Make an offer. With the support of a local team, investors will be ready to begin the process of making an offer on the desired property. In the initial negotiation, the investment team and the seller will come to an agreement on the price and the terms of the purchase agreement. Working with a strong professional team, the investor can then negotiate what is included in the price—such as parking, appliances, furniture and fixtures and storage—in addition to closing costs, down payments, and other important conditions. Step 6: Title due diligence. Once the initial offer is accepted, it is essential to work with a lawyer to ensure the title of the house is clean and problem-free to avoid any legal trouble. While Colombia has undergone tremendous growth, there are a few stray properties purchased with “dirty” money that linger behind as relics of the country’s tumultuous past. A local lawyer can help investors collect and review documents for due diligence, including: Certificado de Tradición y Libertad. This document includes a list of past owners, in addition to any debts or legal claims held against the property. Escritura pública. This is the property title that states its address, its matrícula inmobiliaria—or public lot number—and any restrictions on the sale. Paz y Salvo Predial. This document certifies that municipal taxes on the property have been paid. Paz y Salvo de Valorización. This document certifies that any taxes related to the increase in the value of the property have been paid. Step 7: Sign a Promesa de Compraventa. If investors decide to proceed with their purchase, their lawyer will draft a Promesa de Compraventa, or sell-and-purchase agreement. This contract should outline the final sales price and important terms, including but not limited to: Payment terms, amounts, and dates Any commission, fees, or taxes that remain to be paid Proration of utilities Proration of rental income if a renter is in place Penalties for non-compliance of parties When signing the promesa, investors may also be required to furnish a down payment. Down payments may vary in size but typically come to around 10% of the sale price. Step 8: Transfer money to a brokerage account.

To obtain investor status and for their funds to be legally registered in the country by the Colombian Central Bank, Banco de la República de Colombia, investors typically must transfer money from their foreign account to a Colombian brokerage bank account. Note that it is very important to register the funds correctly as a foreign investment using Form 4 as this will enable you to repatriate the money in the event you sell the property. We strongly recommend working with a lawyer to do this. Step 9: Sign the new Escritura pública. After the day of closing, the Colombian government may take a month or longer to officially transfer the ownership. Once a month has passed, the new owner will receive the new deed, or Escritura pública. Once the deed is signed and notarized, the investor is officially confirmed as the new owner of the property. Step 10: Obtain a visa. Investors who wish to remain in Colombia and establish residency may do so by obtaining a Resident, or Type “R,” visa. With a qualifying investment of at least 650 times the Colombian minimum wage, investors may apply for a five-year visa that may be renewed every additional five years. Investors can also opt for the three year renewable investment visa option at 350 times minimum wage or for 100 times minimum wage they can invest in a Colombian corporation. Own a piece of Colombia If you are thinking about embarking on the exciting but proven process of investing in Colombian real estate, we encourage you to get in touch. We are made up of a diverse team of local and international real estate professionals, lawyers, property management experts, and other Colombia specialists—essentially, everything an investor needs to successfully purchase a great property at a fair price in Colombia. Find out how to generate passive income from Colombian real estate. No longer hidden (though always a gem), Colombia has the world raving about its dynamic destinations, world-class cuisine, and inspiring history. Already beloved by travelers, backpackers, and digital nomads, this South American country has lately been catching the eye of a new kind of extranjero: real estate investors. A thriving economy, unprecedented tourism growth, and historic real estate growth have contributed to unparalleled global investment opportunities in major cities like Bogotá, Medellín, Cali, Cartagena, and beyond. Whether you are planning to do it or are merely curious about investing in the vibrant, colorful, up-and-coming country of Colombia, this article is for you. We explain everything you need to know about investing in Colombia, including an in-depth exploration of the benefits and a step-by-step guide through the process of purchasing real estate legally, safely, and smoothly. Why Colombia? It’s a question everyone gets asked when they announce plans to visit, live, or invest in Colombia to the uninitiated back home: “Why Colombia?” To answer the somewhat complex question from an investment perspective, we offered these compelling reasons to choose Colombia for prospective real estate investors: Economic growth. Nationwide, Colombia has seen historic economic growth since 2002. From Latin America’s fifth-largest economy in 1990, the country has climbed to the rank of Latin America’s third-largest economy with a gross domestic product (GDP) of $330.2 billion USD in 2018. Looking at the next ten years, Colombia’s economic growth is expected to continue to rise at a constant rate due to increasing oil exports, steady consumer consumption, an expanding middle class, development of an interstate highway system, and expanding exports, among other reasons. Thriving real estate market. Colombia’s broader economic growth is reflected in its thriving real estate market. For example Medellín, over the last 15+ years, the city has enjoyed an uninterrupted rise, with real estate prices climbing an average of 7-8% each year. Even as housing prices plummeted in the U.S. during the recession, Medellín saw a 3.4% growth. The trend of growth extends beyond Medellín across the country—and it’s a trend we expects to continue. We estimate that property buyers could see returns between 7-8% on appreciation alone. Depending on the location, property, and upkeep, investors who rent out properties can expect net earnings of 4-7%, resulting in non-leveraged annual returns of 13%+. In the U.S. and many other Western markets, financing is available with 5-20% down and interest rates of 4-6% whereas in Colombia it typically requires 30-40% down and interest rates ranging from 11-14%. The absence of leverage reduces the likelihood of Colombia experiencing a real estate bubble. Skyrocketing tourism rates. Since 2006, tourism across all of Colombia has grown by more than 300%, from one million foreign visitors to more than three million in 2017. Within the first seven months of 2018 alone, more than two million visitors entered the country. Looking ahead, additional tourism growth is forecasted across all of Colombia in the coming years, with Medellín leading the way along with Cartagena, Bogotá, and Cali. The country is expected to further drive increased tourism from new direct flights from Spain, Mexico and several new U.S. states. As Ana Maria Moreno Gómez, Director of the Medellín Convention & Visitors Bureau, predicted in an interview, “Usually, at a worldwide level, tourism is about 10% of GDP. For Colombia, our number is 3.8%, so we have a lot of room to grow.” We see Colombia’s growth in tourism as a boon for investors, as increased tourism rates translate to increased rental demand. Due in part to the country’s proximity to Florida in the United States and the Central and Eastern Time Zone, Colombia has become popular among entrepreneurs and remote or semi-remote professionals who conduct business in the U.S. Compared to travelers and backpackers, professional visitors to Colombia are more interested in high-quality, short-term rentals with both second-home comforts and modern facilities. Diversification. Currency and geography diversification are another reason to invest in Colombian real estate. As the world continues to experience an increase in globalization and interconnectivity, it is especially wise for investors to branch out internationally. Global diversification through investment in Colombia can aid in hedging both currency and geographical risk.

The strength of the Colombian peso versus the U.S. dollar is the only wildcard. But while exchange rates are impossible to predict, the current strength of the USD continues to make Colombian real estate a global bargain. And should the dollar ever weaken, investing in Colombia could offer capital gains of 30-50% just on the currency adjustment alone. High-quality lifestyle. Once marred by a reputation for being dangerous and unstable, Colombia has undergone an inspiring transformation, shedding its reputation for violence and replacing it with one of culture-packed cities, diverse landscapes, and tremendous economic and social progress. The current strength of the dollar against the peso allows USD investors who choose to live or travel in Colombia to enjoy cosmopolitan comforts at a fraction of the cost of many Western countries. In fact, many senior citizens struggling to live on their social security in the U.S. could live quite comfortably in Colombia. Visa eligibility. A final benefit of investing in Colombian real estate? By purchasing eligible property in Colombia, investors can obtain a residency visa and put themselves on the pathway to obtaining a second passport. Making an investment of 650 times the Colombian minimum monthly salary will make you eligible for a resident visa, which extends for up to five years and may be renewed. After five years of residency, investors may be eligible to apply for Colombian citizenship and there are even less expensive investor visa options available today for as little as $25,000 USD. Having a “backup residency” is more important than ever. Establishing legal residency or holding a second passport provides security and travel freedom in addition to what many expats consider to be a superior lifestyle. Why not speak to one of our real estate specialists about purchasing property in ? We are a boutique investment firm with years of experience delivering bespoke residence and citizenship-by-investment solutions for international families. At Prime Land Ventures, we can simplify access to property investments, provide local insights, help with legal assistance, tax planning, and more—all while ensuring efficient, personalized, and confidential service The UK is no longer accepting applications for the Entrepreneur visa (Tier 1). Instead, the government has introduced two new visas for business innovators and start-up owners. The Entrepreneur Visa has been available in the UK since 2008. To obtain it, a foreigner had to buy government bonds or invest at least £2 million in a local company. In exchange, the UK allowed them to enter the country without restrictions, to work and to do business there. Since 2008, 12,517 foreigners have been granted an Entrepreneur Visa. They have added around £6.25 billion to the country’s budget. Why the UK has abolished the Entrepreneur Visa Demand for Entrepreneur Visa fell in 2020 due to the financial crisis, the pandemic and Brexit. The country’s income from investment was £328 million – half of what it was in 2019. We told you about the statistics in the article “Russians are 3rd most likely to apply for a residence permit”. The new visas are also due to the UK’s new immigration policy. From 1 January 2021, a points-based residence permit system is in place. Applicants must score at least 70 points in order to obtain a work or student visa. The assessment takes into account the applicant’s age, specialization and level of qualification. Falling demand may have been the reason why the government decided to scrap Entrepreneur Visa. And in revising the system, the Home Office replaced it with two new options. What kind of visa an investor can get in 2021 If a foreigner wants to start a business in the UK, they can get an Innovator Visa or a Start-up Visa. The new visas allow you to live, work and do business in the UK and enter the country without restrictions. Family members such as a spouse and minor children can be granted a visa along with the investor. Innovator Visa Innovator Visa is given to foreigners who present an original business project. The idea must be different from anything already on the market. The business project is also approved by one of the authorized organizations from a list approved by the UK government. The visa conditions do not set a minimum investment amount, e.g. for the share capital of a new company. But the foreigner does pay an application fee of £1,021 per applicant. Applicants for the Innovator Visa also have to prove their knowledge of English at the B2 level. For example, they take the Secure English Language Test. The Innovator Visa is issued for three years, after which it can be renewed an unlimited number of times. If the visa holder has lived in the country for three years, they are eligible to apply for permanent residence. Start-up Visa

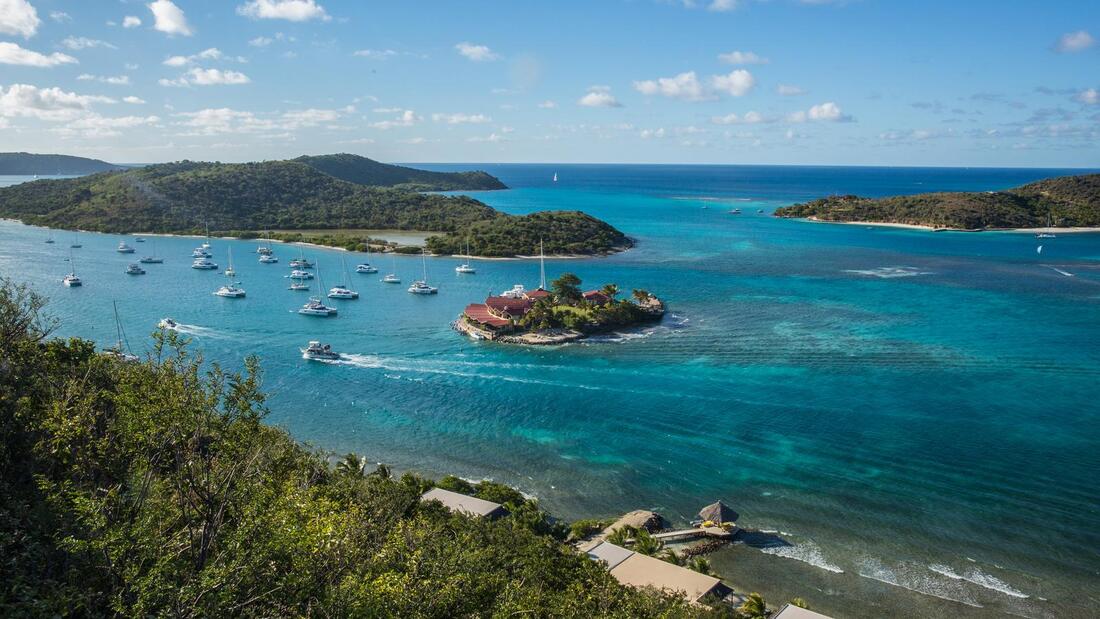

The Start-up Visa is also for those planning to start an innovative business in the UK. The candidate approves their business project at one of the country’s universities or at a business organization that supports entrepreneurs. There is also no minimum investment amount. The application fee is £363 per applicant. A foreigner receives a visa for two years, but it cannot be extended. If the startup owner wants to stay in the country after the visa expires, it can obtain an Innovator Visa. A Caribbean passport can be an alternative to a British visa if the main purpose of the investor is to travel freely to the UK. Five countries in the region allow citizenship for an investment of $100,000 or more. Citizens of these countries can come to the UK and spend up to 180 days in the country in one year. We are a boutique investment firm with years of experience delivering bespoke residence and citizenship-by-investment solutions for international families. At Prime Land Ventures, we can simplify access to property investments, provide local insights, help with legal assistance, tax planning, and more—all while ensuring efficient, personalized, and confidential service St. Lucia lies in the eastern Caribbean Sea, northwest of Barbados and south of Martinique. A volcanic island mostly covered in rainforest, it is famous for its twin peaks — the Pitons — and its magical beaches. St. Lucia is a member of the Commonwealth and CARICOM and has excellent air links to Europe and North America. Benefits of St. Lucian citizenship A St. Lucian passport provides visa-free or visa-on-arrival travel to 146 destinations including Europe’s Schengen Area, Hong Kong, Singapore, the UK, and many others.

Requirements of the St. Lucia Citizenship Program The citizenship by investment program of St. Lucia for a single applicant starts at US$ 135,000 including all fees and all investments (higher for families). The investment options include (excluding processing fees): A) A non-refundable contribution (donation) to the National Economic Fund of US$ 100,000 (single applicant), OR B) An investment of at least US$ 250,000 into 0% Covid-19 Relief Bonds (until Dec. 31, 2020), holding these bonds for at least 5 years, OR C) An investment of at least US$ 300,000 directly into an approved real estate development to be held for at least five years, OR D) An investment of at least US$ 500,000 directly into St. Lucia government bonds to be held for at least five years, OR E) An investment of at least US$ 3,500,000 into an approved corporate business project that creates at least three local jobs. Applicants for citizenship must be at least 21 years of age, of good character, and without criminal records. There is no physical stay requirement, and the application process can be as fast as 3 - 4 months. Procedures and time frame

The application process should take no longer than four months from submission of the application to issuance of the certificate of citizenship, assuming there are no areas of concern with the application. Where, in exceptional cases, it is expected that the processing time will be longer than three months. The Citizenship-by-Investment Board, which provides oversight to a dedicated citizenship-by-investment unit (CIU), will consider an application for citizenship and its outcome may be to either grant, deny, or delay for cause. A citizenship-by-investment application will be submitted in electronic and printed form. All requisite supporting documents must be attached to an application before it can be processed by the CIU. All applications must be accompanied by the relevant nonrefundable processing and due diligence fees for the principal applicant, their spouse, and each qualifying dependent. Where an application has been approved in principle, the CIU will notify Prime Land Ventures that the qualifying funds and requisite government administration fees must be paid before the certificate of citizenship can be granted. The main applicant must remit the required funds for the qualifying option within 90 calendar days after notice of approval of their application. A successful applicant shall sign the oath or affirmation of allegiance before an attorney-at-law, notary royal, or notary public. The minister may, by order, revoke a grant of citizenship in exceptional circumstances as may be deemed necessary. Why not speak to one of our real estate specialists about purchasing property in Saint Lucia ? We are a boutique investment firm with years of experience delivering bespoke residence and citizenship-by-investment solutions for international families. At Prime Land Ventures, we can simplify access to property investments, provide local insights, help with legal assistance, tax planning, and more—all while ensuring efficient, personalized, and confidential service |

Archives

March 2021

Categories |

We Would Love to Have You Visit Soon!

Hours

M-F:

7am - 9pm |

Email

sales@primelandventures.co

|

Locations

|

© Prime Land Ventures 2022

RSS Feed

RSS Feed